The financial technology (FinTech) landscape is transforming rapidly, with stock APIs playing a pivotal role in redefining how data is accessed, analyzed, and applied. As financial markets evolve and user expectations grow more sophisticated, developers and institutions are turning to robust API solutions to fuel the next wave of trading platforms, portfolio management tools, and investment applications.

Understanding the Role of Stock APIs in Modern Finance

Stock APIs serve as bridges between raw market data and usable financial insights. These interfaces allow developers to access real-time and historical data, integrate financial charts, apply technical indicators, and more—directly within their platforms.

Why APIs Matter in FinTech

In today’s digital environment, speed and precision are essential. Stock APIs enable:

- Seamless integration of real-time stock quotes and indices

- Access to comprehensive historical datasets for strategy testing

- Implementation of advanced analytics and automated alerts

- Efficient data visualization with live charts and customizable dashboards

Providers like fcsapi offer these capabilities to support scalable, data-centric financial solutions for traders, investors, and developers.

Key Ways Stock APIs Are Driving FinTech Innovation

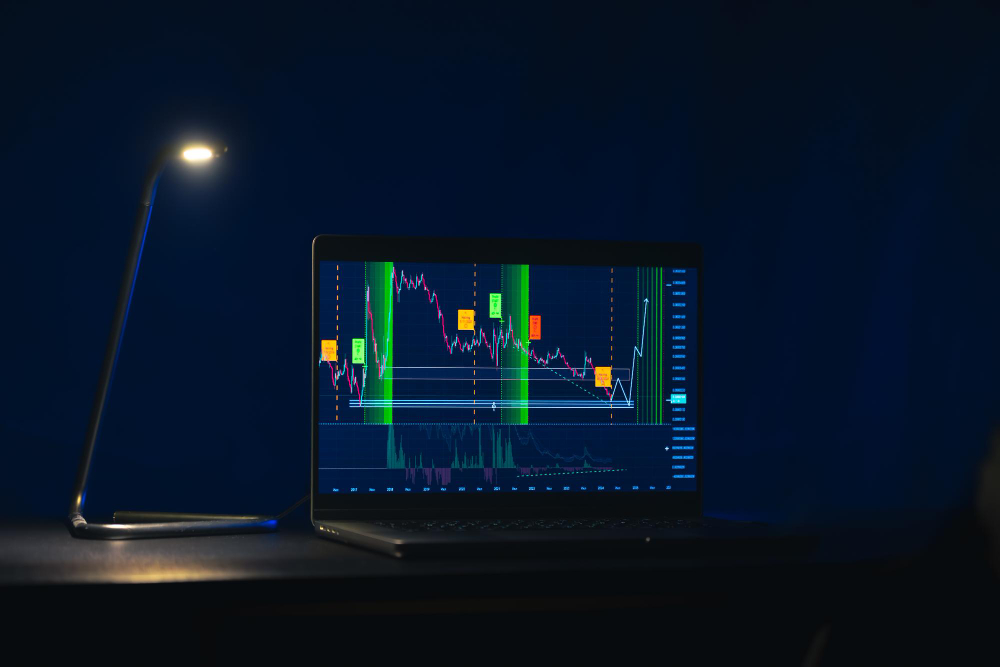

1. Enhancing Trading Platforms with Real-Time Data

Modern traders rely on instant market insights. Stock APIs enable real-time updates, ensuring users can monitor price fluctuations, volume changes, and technical movements as they happen.

fcsapi delivers real-time stock, forex, and crypto data, along with interactive charts and economic calendars—empowering users with a complete view of market dynamics.

2. Supporting Algorithmic and High-Frequency Trading

Algorithmic trading strategies depend heavily on timely and reliable data inputs. With access to historical and tick-level data, stock APIs help developers build, test, and deploy automated trading systems.

By using an API like fcsapi, traders can:

- Access structured and consistent data formats

- Retrieve specific financial instruments for backtesting

- Incorporate technical indicators for strategy optimization

3. Powering FinTech Applications with Actionable Insights

From robo-advisors to personal finance tools, FinTech applications require robust data feeds to provide recommendations, generate reports, and display charts.

With access to fcsapi’s broad financial data coverage, developers can:

- Enable portfolio tracking across asset classes

- Display historical performance trends

- Analyze market sentiment with integrated news feeds

4. Facilitating Data-Driven Decision Making

Investors and institutions use analytics to guide portfolio decisions and manage risk. Stock APIs make it easier to visualize trends, compare performance metrics, and monitor economic indicators in real time.

fcsapi enhances this process through:

- Consistent API performance and response speed

- Data endpoints for stocks, commodities, cryptocurrencies, and forex

- Market summaries and economic event tracking

What to Look for in a Stock API Provider

As FinTech continues to grow, choosing a reliable API provider is more important than ever. Key attributes to consider include:

Data Breadth and Depth

Look for coverage that spans global markets and includes historical datasets, live charts, and technical tools.

Ease of Integration

A quality API should come with detailed documentation, flexible endpoints, and support for various development environments.

Reliability and Support

APIs must offer consistent uptime, fast response speeds, and dedicated support for smooth implementation and long-term stability.

Compliance and Security

Ensure the provider adheres to financial regulations and follows secure data handling practices.

Why fcsapi Is Aligned with FinTech Evolution

fcsapi delivers a robust and flexible suite of financial APIs designed to support modern trading, investing, and financial analysis platforms. Its offering includes:

- Real-time and historical data for stocks, forex, crypto, and commodities

- Customizable charts and dashboards

- Market summaries and technical indicators

- Economic calendar integration for macro trend analysis

With a strong focus on usability and performance, fcsapi enables brokers, traders, financial professionals, and developers to build responsive, data-driven applications that meet the demands of the modern marketplace.

Conclusion

Stock APIs are reshaping the future of trading and financial technology. They serve as the foundational tools behind algorithmic strategies, investment platforms, trading dashboards, and more. As the FinTech industry continues to expand, leveraging the capabilities of a reliable stock API provider like fcsapi will be key to staying competitive and data-informed.