Learning to trade in a new market is like learning a conversation in a new language. It becomes easier when you understand basic ideas and concepts and see many vocabularies. Let’s start with the basic concepts of Forex trading before we move on to learning how to use the trading station. For a more detailed introduction to the forex market, you can find the Investopedia guide for Forex Beginners: http://bit.ly/2kvOxfM

WHAT IS FOREX?

The word Forex is a common abbreviation of the term foreign exchange and generally describes the process of buying and selling in the foreign exchange market, especially by investors and speculators. The well-known phrase “Buy at a low price and sell at a high” applies to currency trading. The Forex trading method is identical to that of stock exchanges.

HOW TO READ THE QUOTATION

What you always do when trading currencies is to compare the price of one currency to another, which is why Forex quotes are displayed in pairs. This method of presentation, though initially confusing, is quite simple. For example, if the price of EUR / USD equals 1.4022, that is the value of one euro (EUR) in US dollars (USD).

WHAT IS A LOT?

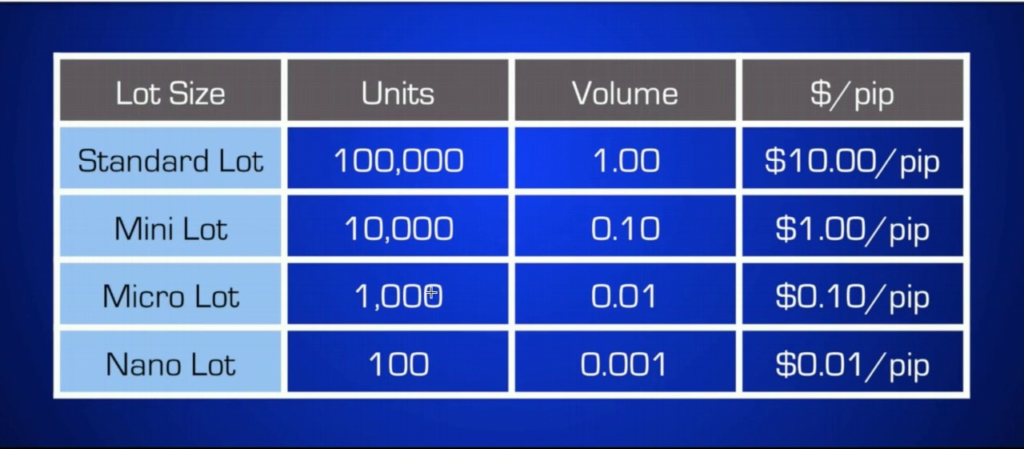

A lot is the smallest volume of a currency deal. There is a standard lot size in our accounts, which is made up of 1000 units of currency. Account-holders may trade in different sizes as long as multiples of 1000 units: 2000, 3000, 15,000, 112,000 and so on.

WHAT IS A PIP?

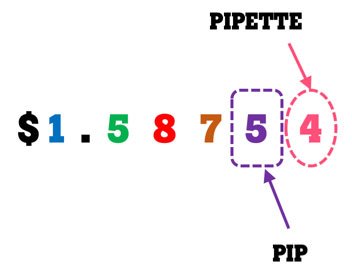

A pip is a unit of measure of profit and loss. Most currency pairs are quoted for the fourth decimal place except for the Japanese Yen. The pip is usually calculated by looking at the fourth digit after the decimal point (at 1 percent of a cent). Moving any number on this site from the quotation (ie the fourth digit after the decimal point) is a move in the number of points (pip). For example, if the EUR / USD goes up from 1.0422 to 1.4027, it means a 5 pips rise in the EUR / USD.

WHAT IS MARGIN OR LEVERAGE?

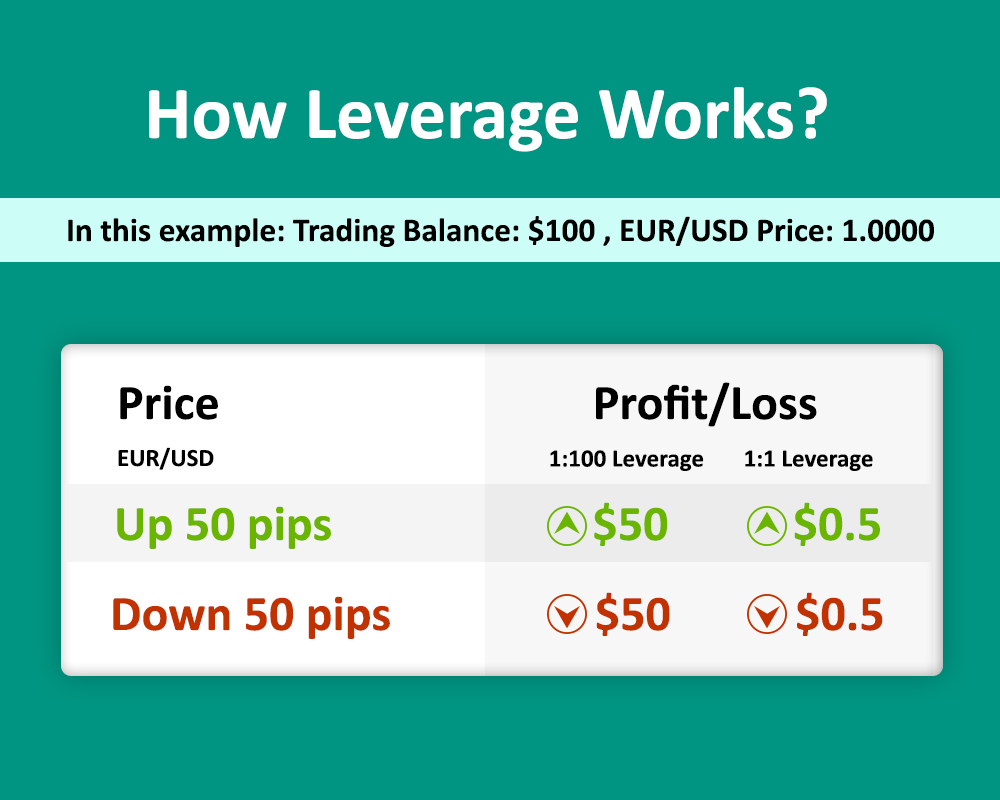

We have already mentioned that all trades are executed with borrowed funds, giving you the opportunity to benefit from leverage. When using a leverage of 400: 1 you can trade in the market for $ 1000 when you invest only $ 2.5 as a security deposit. Leverage enables you to take advantage of even the simplest currency rate movements by disposing of more money in the market than in your account. On the other hand, there may be significant losses when using the leverage, trading foreign currencies using leverage, at any rate, may not be suitable for all investors.

The exact amount to be deposited for a position is called “margin requirements”. Margin can be considered as a deposit or security that you neutralize to maintain your open positions. It is not a commission or trading fee. Margin is simply part of the funds deposited in your account that are neutralized aside as margin deposits.

Forex Currency Stock API is able to provide real-time exchange rate data for global currencies. This API comes with multiple endpoints, each serving a different usage state. Endpoint functionality includes getting the latest exchange rate data for all currencies or a specific set of currencies, converting currency from one currency to another, restoring time series data for a currency or multiple currencies, and querying the daily volatility data API.

Forex Currency Stock API is able to provide real-time exchange rate data for global currencies. This API comes with multiple endpoints, each serving a different usage state. Endpoint functionality includes getting the latest exchange rate data for all currencies or a specific set of currencies, converting currency from one currency to another, restoring time series data for a currency or multiple currencies, and querying the daily volatility data API.