The ticker opened at 428 and closed at 419.2. Down about two percent in a single session but the signal flipped to Strong Buy with high confidence and a 90.4 score. That's the kind of day that separates people who read the chart from people who panic at red.

I've watched too many retail traders bail on a 2% dip only to miss the next leg up. This isn't a broken stock. It's consolidating after a run. The ADX reading alone tells you everything you need to know about trend strength.

The Signal Score Breakdown

90.4 signal score with high confidence. Not borderline, not a coin flip. The system is screaming momentum and the technicals back it up.

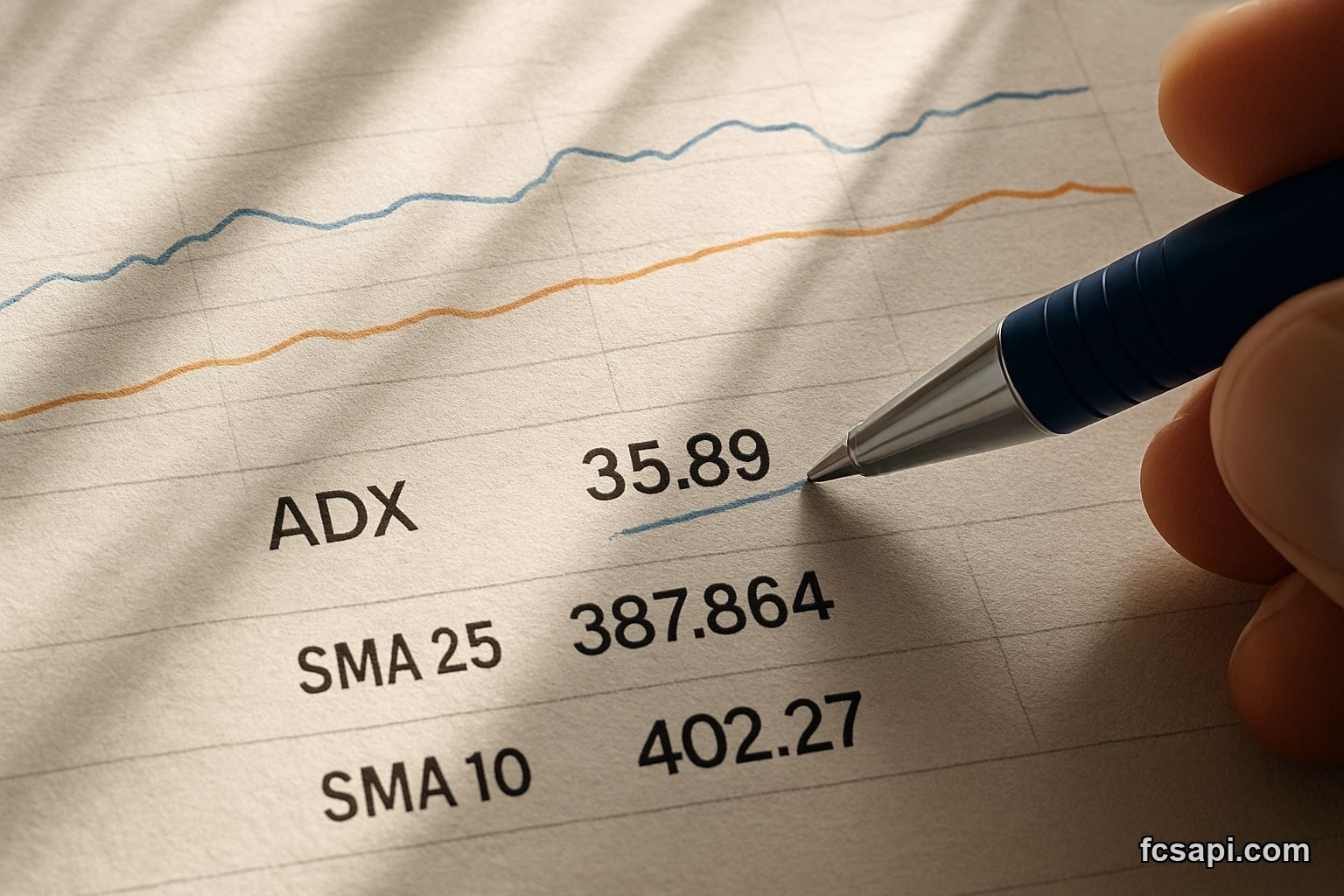

ADX sits at 35.89, marked as Strong Buy. If you don't know ADX, it measures trend strength regardless of direction. Anything above 25 is strong. Above 35? That's a freight train. The price action might wobble but the underlying trend is intact.

Stochastic K% at 71.7 also signals Buy. Not overbought yet, not sitting in no-man's-land. It's in that sweet spot where momentum traders start piling in.

- ATR: 8.8726 — volatility's there but not chaotic

- SMA 25: 387.864 — price trading 8% above the 25-day

- SMA 10: 402.27 — even the short-term average confirms support

Both moving averages show Strong Buy. When short and medium-term averages line up like that, it's not noise. It's confirmation.

Price Action and Support Levels

The one-month high hit 434.8. We're about 3.6% below that. All-time low was 339.455, so we're trading 23% above the floor. Context matters. This isn't a stock teetering on the edge of collapse.

Look at the pivot points. Demark puts resistance at 427.65 and support at 418.15. We closed at 419.2 — literally just above support. Camarilla R1 is 422.171, S1 at 420.429. Tight range, which means the next move probably happens fast.

I'd be watching that 418 level hard. If it holds, the setup's valid. If it breaks, reassess. But right now the data says the floor's solid.

What the Moving Averages Tell You

Price sitting above both the 10-day and 25-day averages. That's bullish structure. When you're trading above moving averages in a strong ADX environment, pullbacks are usually bought. Not always, but usually.

The 10-day at 402 gives you about 4% cushion. The 25-day at 387 gives you another 8%. Those are your reference points. As long as the price stays above those, the trend's your friend and all that.

I've seen people overthink this. They want ten confirmations before they act. The confirmations are already here. ADX strong, stochastic favorable, moving averages aligned, signal score near 91. What else do you need?

Bangladesh Market Context

This is a Bangladesh-listed stock, which comes with its own quirks. Liquidity isn't the same as New York or London. News flow can be sparse. But that's also where inefficiencies live. The stock API data picks up these setups before the crowd does.

Walton Hi-Tech makes appliances, electronics, consumer goods. It's not some speculative penny stock. Real revenue, real market share in Bangladesh. The fundamentals aren't included in this dataset but the price action suggests institutional interest.

Emerging markets get oversold on any hiccup. A 2% drop in a developed market is Tuesday. In Bangladesh, people act like the sky's falling. That overreaction creates opportunity if you're reading the technicals right.

Risk and What Could Go Wrong

Strong Buy doesn't mean risk-free. The ATR reading shows average true range near 8.87. That means daily swings of roughly 2% aren't unusual. If you're expecting a straight line up, recalibrate.

The one-month high at 434.8 is resistance until it's not. We could bounce around this 418-428 range for days or weeks. Patience matters. Signal's there, but timing isn't instant.

Bangladesh geopolitical or economic headlines could move the whole market. Currency risk if you're trading in dollars or euros. Local regulations, tax changes, all that. I don't track every headline but I know the risks exist.

If price drops below 418 and stays there, the setup changes. Don't marry a trade. FCS API updates signals daily and you should be checking them.

How I'd Play This

I'd be looking for entry near current levels or on a minor dip toward that 418 support. Stop loss probably just under 415 to give it breathing room but protect against a real breakdown. Target the prior high at 434.8 for a quick 3-4% move, or hold longer if momentum sustains.

Position size depends on your risk tolerance and portfolio. I wouldn't go all-in on a single emerging market name no matter how strong the signal. But as part of a diversified setup? Makes sense.

Check the API pricing plans if you want live data instead of lagging sources. The faster you see the signal, the better your entry. That's been the difference for me more than once.

More stock analysis and setups here if you want to compare other opportunities. But right now, this one's got my attention.

Is a 90.4 signal score with ADX above 35 enough to ignore a 2% pullback?